Agility and adaptation are key to remaining relevant in a constantly changing financing landscape. In order to survive, many Indian businesses are entering new markets via acquisitions, divestitures and fundraising. This has resulted in a frenzy of deal activities in India. The uptick in investments has been stepped up across infrastructure sectors as the government’s capital push continues to drive core industries. Policy certainty in the country due to measures such as the production-linked incentive (PLI) scheme is also partially linked to the rise in investments.

Agility and adaptation are key to remaining relevant in a constantly changing financing landscape. In order to survive, many Indian businesses are entering new markets via acquisitions, divestitures and fundraising. This has resulted in a frenzy of deal activities in India. The uptick in investments has been stepped up across infrastructure sectors as the government’s capital push continues to drive core industries. Policy certainty in the country due to measures such as the production-linked incentive (PLI) scheme is also partially linked to the rise in investments.

The availability of private equity (PE) dry powder and foreign direct investment was a key contributor to the deal activity witnessed in 2022. India has surpassed China in PE-backed merger and acquisition (M&A) activity for the first time since 2008. It accounted for 28 per cent of the global market share, while China’s market share stood at 24 per cent.

Charting growth

Despite the headwinds from disruptions in global supply, inflation, firm crude prices and other looming uncertainties, as per EY, the overall deal activity in India touched an all-time high of $148 billion in the first nine months of 2022, defying the global slowdown. It was 58.2 per cent higher than in 2021, a year that had already witnessed a remarkable spike in deal activity, outperforming 2020 by 40 per cent in terms of value and 60 per cent in terms of volume. However, despite an annual turnaround, the overall PE/ venture capital (VC) investments for the third quarter of 2022 totalled $8.3 billion, a 68 per cent decrease from the third quarter of 2021, breaking the monthly average run rate of $5 billion seen in the initial months of 2022.

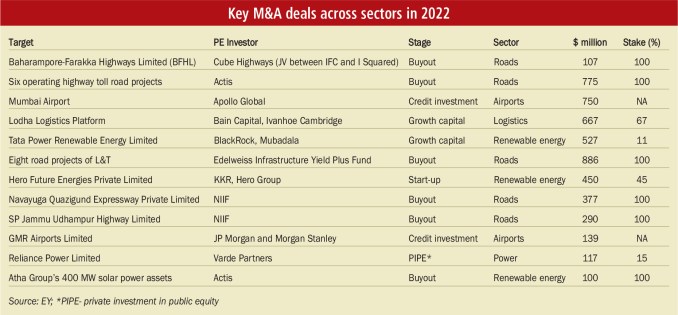

Barring pure-play investments, the infrastructure sector, along with the real estate sector, was the only industry to record an increase in PE/VC investments. PE transactions are on track to increase their share in the M&A space. The infrastructure sector received the maximum PE/VC investments in the third quarter of 2022, at $2.6 billion across 12 deals, a 63 per cent year-on-year increase from $1.6 billion in the third quarter of 2021. The largest deals witnessed in the quarter include the Edelweiss Infrastructure Fund’s buyout of eight road projects from Larsen & Toubro (L&T) for $886 million.

Mega deals

Investor interest has been sparked by the government’s emphasis on digital infrastructure, services infrastructure and physical infrastructure. As a result, the infrastructure space is viewed by investors as a rapid growth sector ensuring steady profit margins.

With Adani’s acquisition of the Holcim Group’s Indian assets, the country’s cement industry is gaining momentum. This transaction has helped the domestic market transition from a sellers’ market to an aggressive buyers’ market as many companies are now looking to scale up.

The Indian renewable energy sector continues to be very dynamic, with favourable policies and intense competition. Acquisitions have shown a growing trend in the renewable energy sector since the beginning of this year, and this is likely to continue in the near future, with a few big acquisitions already announced and some at advanced stages of completion. Some of the big-ticket deals include Shell’s acquisition of Sprng Energy, JSW’s planned purchase of Mytrah, and Waaree’s approved buyout of Indosolar.

In the road space, there has been a total of 26 asset sales worth Rs 408.89 billion over the past three years.  The primary motivation for these transactions has been the developers’ need to unlock capital by monetising operational assets. The generated capital has further been used to bid new projects, reduce debt, and improve liquidity. Additionally, KKR, the National Investment and Infrastructure Fund (NIIF), Cube Highways and Sekura Roads are negotiating the acquisition of three premier road assets in south India – Navayuga Udupi Tollway in Karnataka, Thrissur Expressway in Kerala, and Kotak Special Situations Fund-owned HKR Roadways in Telangana.

The primary motivation for these transactions has been the developers’ need to unlock capital by monetising operational assets. The generated capital has further been used to bid new projects, reduce debt, and improve liquidity. Additionally, KKR, the National Investment and Infrastructure Fund (NIIF), Cube Highways and Sekura Roads are negotiating the acquisition of three premier road assets in south India – Navayuga Udupi Tollway in Karnataka, Thrissur Expressway in Kerala, and Kotak Special Situations Fund-owned HKR Roadways in Telangana.

The Indian telecom market is brimming with opportunity as the country is finally ready to step into the 5G era. Reliance Jio with its acquisition of 700 MHz spectrum plans to create standalone 5G architecture, which has long-term advantages such as superior quality, ultra-low latency 5G experience and a wider range of applications, particularly for the enterprise segment. Another noteworthy transaction is Bharti Airtel’s acquisition of 127,105,179 equity shares (about 4.7 per cent stake) of Indus Towers from Euro Pacific Securities.

The aviation industry was severely hit by Covid-19. Due to their high profit margins, aviation companies are encountering a liquidity crisis and are hedging their bets to stay afloat. The country’s leading airline, Indigo (with a 60 per cent market share) has been selling assets and leasing planes to offset huge losses. Following suit, the Tata Group has commenced the process of merging its airline business under a single umbrella, the Air India brand. This transaction will make Air India the second-largest airline in terms of fleet size and market share in India. M&A activity in the aviation space can help increase market power over specific routes and hubs, as well as an improved contract structure and negotiating position in operations.

Data centres have emerged as the new sought-after alternative commercial real estate investment asset class globally, with hyperscalers committing to invest in digital infrastructure in India. Google has committed $10 billion, Amazon Web Services plans to invest $1.6 billion and Microsoft has committed $2 billion.

Optimistic outlook

Optimistic outlook

India is well positioned to attract private equity investments due to its robust macroeconomic fundamentals and favourable demographics. With the implementation of investor-friendly measures to promote ease of doing business in India, an increase in investment volumes is anticipated.

The increase in M&A transactions is expected to continue as more firms are opting to go public in the domestic and international markets. As firms and PE funds increase their efforts to limit carbon emissions, more capital will be mobilised for the transition to greener sources of energy, generating M&A opportunities.