The Indian road sector has witnessed a marked shift from the operations, maintenance and transfer (OMT) model to the toll-operate-transfer (TOT) model. From the investor perspective this is a welcome change. The investor fraternity has been expressing increasing interest and keenness towards the new model. This is, in part, due to the proactive redressal of investor concerns related to the tolling history of the selected road stretches and the operations and maintenance (O&M) obligations. Rajesh Sharma, chief general manager, finance, National Highways Authority of India (NHAI), talked about the potential for TOT, the experience so far and NHAI’s asset monetisation plans at a recent conference on OMT in the Road Sector organised by India Infrastructure. Excerpts…

The Indian road sector has witnessed a marked shift from the operations, maintenance and transfer (OMT) model to the toll-operate-transfer (TOT) model. From the investor perspective this is a welcome change. The investor fraternity has been expressing increasing interest and keenness towards the new model. This is, in part, due to the proactive redressal of investor concerns related to the tolling history of the selected road stretches and the operations and maintenance (O&M) obligations. Rajesh Sharma, chief general manager, finance, National Highways Authority of India (NHAI), talked about the potential for TOT, the experience so far and NHAI’s asset monetisation plans at a recent conference on OMT in the Road Sector organised by India Infrastructure. Excerpts…

Asset recycling: The Indian experience

Contextually, asset recycling refers to leveraging of infrastructure assets that have been created in the past and utilising the proceeds so generated to fund new infrastructure creation. In the Indian scenario, the funds generated will be used for new programmes such as Bharatmala. Thus, asset recycling has dual benefits as it unlocks the potential of existing assets and generates proceeds for investing in new assets. Apart from these benefits, the advantages of the model include fund utilisation for priority development to serve social service and economic needs, low concessionaire risk and long-term investment opportunity.

NHAI’s asset recycling programme aims at recycling operational projects through the TOT model. The selection of projects is made on the basis of operational stability and proven tolling history. In addition, the criteria for bundling are geographical proximity and appropriate size. In order to provide full information to prospective bidders, NHAI has conducted comprehensive technical studies. These studies include 360 degree evaluation of asset parameters (using Mobile LiDAR surveys and drone videography), technology-driven investigations (traffic volume count surveys, pavement investigations using both falling weight deflectometer and network survey vehicles) as well as a systematic approach to analysing data and evaluating highway assets.

Understanding TOT

Understanding TOT

The TOT model is a comparatively novel thing in India’s infrastructure space. Aimed at attracting participation from private players, the TOT model encompasses four key elements. These entail the appointment of the private party through competitive bidding, upfront payment of a lump-sum amount to the asset owner, long-term toll collection rights backed by a sound policy framework, and O&M obligations of the concessionaire. However, if required, NHAI can bear the cost of undertaking capacity augmentation.

This model is an advancement with respect to the OMT model, in which a key concern plaguing the financial investors was having to bear the construction risk. Under the TOT model, the investors have been completely absolved of the construction risk as attracting financial investors is one of the prime objectives of the TOT model. An additional benefit under TOT is an easy exit route for prospective investors/bidders. This provision has been added in order to provide ease of entry and exit for investors.

The concession period under the TOT model is typically about 30 years for a one-time concession fee that the concessionaire has to pay upfront. Divestment of up to 49 per cent is allowed in the first two years of the concession period and up to 100 per cent change in ownership is allowed after the completion of two years. The user fee collection is to be governed by predetermined fee rules. Moreover, traffic sampling will be done in the tenth and twentieth years of the concession period to assess toll variations. The termination payments will be based on the unexpired cash flows. Another attractive feature of the model is the provision of a well-defined and mature dispute resolution procedure.

The financial and technical requirements for qualification of the second TOT bundle have been kept at a bare minimum level. They have been formulated keeping in mind investors who do not have a lot of experience in the sector. These investors can meet the technical qualification requirements through the formation of joint ventures (JVs) with Indian partners.

Upcoming TOT bundles

Upcoming TOT bundles

Under Phase I of the TOT programme, around 75 projects spread across seven bundles have been selected for asset recycling. Bundles will be bid out in a phased manner over the next two to three years with an average bundle size of about $1 billion and an average length of about 500 km.

The first bundle was awarded to a JV of the Macquarie Group and Ashoka Buildcon Limited. TOT Bundle I comprises three projects from Gujarat and six projects from Andhra Pradesh. The bundle spans a length of 681 km and comprises 10 toll plazas. NHAI had four bidders in the fray – Macquarie-Ashoka, IRB Infrastructure, Brookfield Asset Management and the ROADIS-National Infrastructure and Investment Fund consortium. The winning bid was valued at Rs 96.81 billion. This bundle has been successfully awarded at 1.5 times NHAI’s assessed value of Rs 62.58 billion. TOT Bundle I has attracted huge interest from investors. More than 2,000 queries were received by many prospective bidders. In addition, TOT Bundle I resulted in a total cash flow of more than Rs 105 billion for the road sector.

The second bundle comprises 12 toll plazas across eight project stretches aggregating a length of 588.55 km. Currently, the bidding process for this bundle is in progress and the bid submission date has been extended from November 5 to December 5, 2018. As far as the bids are concerned, NHAI is expecting 8-10 bids, which is double the number of bids that were received for the first bundle. The concessionaires are required to bid against an estimated concession value of Rs 53.62 billion.

For TOT Bundle II, a marketing plan has been devised. NHAI has conducted two domestic (New Delhi and Mumbai) and two international (New York and Toronto) roadshows in order to promote India’s TOT programme among the investor community. The roadshows, besides being a part of the marketing plan for Bundle II, provided a platform for NHAI to clear some common misconceptions regarding India’s infrastructure sector. The roadshows were attended by a whole gamut of investors.

For TOT Bundle II, a marketing plan has been devised. NHAI has conducted two domestic (New Delhi and Mumbai) and two international (New York and Toronto) roadshows in order to promote India’s TOT programme among the investor community. The roadshows, besides being a part of the marketing plan for Bundle II, provided a platform for NHAI to clear some common misconceptions regarding India’s infrastructure sector. The roadshows were attended by a whole gamut of investors.

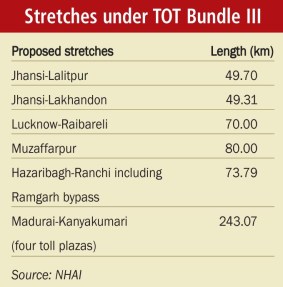

NHAI has also obtained approval for the third and fourth bundles spanning a total length of 565.87 km and 479.19 km respectively. The detailed project reports for these stretches are being prepared.

Future plans

At present, NHAI is undertaking preparatory works for future TOT bundles that will be put on the block in a phased manner. In this context, another five bundles for TOT aggregating 3,605 km are planned to be rolled out in the next two years. Given the huge investment potential offered by TOT, it is likely to attract interest from both domestic and international investors.