The Indian rolling stock market is witnessing steady growth, driven by new metro projects as well as the extension of existing lines. As of March 2018, a total of at least 2,115 railcars are operational across nine metro rail projects. The Delhi metro has 1,396 operational railcars, the highest number in the country, simply due to the fact that the city has the largest operational metro network of 263.45 km. It is followed by the Kolkata metro with 216 railcars and the Bengaluru metro with 150 railcars under operation.

Given the rapidly increasing ridership, cities across the country are experimenting with state-of-the-art technologies to make urban rail systems more efficient, reliable and passenger friendly. Indian metro systems are steadily moving from semi-automatic to unattended/driverless train operations. The new trains boast of features such as higher acceleration, lightweight stainless steel bodies, LCD screens for route maps, mobile and laptop charging sockets, spacious seating, and regenerative electric braking. Most of the upcoming systems are exploring deployment of more advanced technological solutions for passenger comfort and safety.

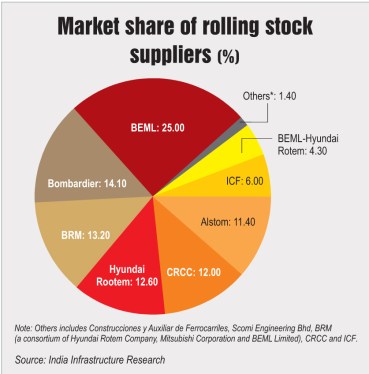

Key rolling stock suppliers

The rolling stock market is dominated by players such as Bengaluru-based BEML, Canada-based Bombardier, South Korea-based Hyundai Rotem, China-based China Railway Construction Corporation (CRCC), Spain-based Alstom, etc. These companies together have a market share of 88.2 per cent.

BEML is the only large domestic player. It has a technology transfer arrangement with Hyundai Rotem to manufacture metro coaches in India. The Integrated Coach Factory (ICF) is another major domestic player. It has supplied broad gauge coaches for the North-South Corridor of the Kolkata metro project.

The rolling stock market has also witnessed the entry of new global players in the past few years. Chinese player CRCC is the latest entrant in the Indian market. The company secured contracts to supply 76 coaches for the Noida-Greater Noida metro and 69 coaches for the Nagpur metro. Further, Kawasaki Heavy Industries and Hitachi are expected to enter the market soon. Kawasaki is partnering with Bharat Heavy Electricals Limited to make stainless steel coaches for metro trains. Hitachi has also expressed interest in participating in rolling stock bids. It recently bid for the Mumbai metro Line 3 (SEEPZ) project.

Future railcar demand

The installed base of metro rail rolling stock in India is expected to increase to 5,458 railcars by 2023. A total of 3,343 railcars are planned to be added to the metro network over a period of five years (2018-23). Of these, contracts have been awarded for 1,758 railcars (52.58 per cent).

The maximum number of orders has been placed for the Delhi metro, followed by the Kolkata, Bengaluru and Hyderabad metros. Besides expansion projects, orders have also been placed for new metro projects in Kochi, Noida, Nagpur, Ahmedabad-Gandhinagar and Navi Mumbai.

Contracts are yet to be awarded for 1,585 railcars (47.42 per cent). Most of the opportunities will be provided by the Mumbai metro, which is yet to award contracts for 588 metro railcars under different phases. This is followed by the Kolkata metro, which is expected to place orders for 504 new metro railcars for its expansion project.

Big push by network expansion

The increase in rolling stock is driven by the growth in India’s metro rail network, which is planned to be increased from 438.7 km in 2018 to 1,060.88 km by 2023. Of the total network addition, 210.7 km will be added as part of five new metro systems – Kanpur metro, Nagpur metro, Visakhapatnam metro, Ahmedabad-Gandhinagar metro and Pune metro. During the period 2018-23, while the overall metro network will expand at a compound annual growth rate (CAGR) of 24.7 per cent, the demand for rolling stock is expected to increase at a CAGR of 26.7 per cent. Around 69 per cent of the demand for railcars is expected to come from the Mumbai metro and Kolkata metro extension projects.

The development of the light rail transit (LRT) system is also expected to create new demand for rolling stock. Currently, 10 LRT projects covering a total length of 380.66 km are planned to be taken up in the future. This will be supplemented with the expansion of metro systems to Tier II and Tier III cities. Thus, the total rail rolling stock requirement over the next few years is estimated to be 1,000-1,500 cars per year.

Backward linkages and indigenisation

The emergence of the metro sector and the government’s renewed focus on improving public transportation in urban areas has resulted in the development of not only the metro coach industry but also that of the metro equipment and spare parts industry. Metro coaches and other parts including window glasses, battery boxes, brake blocks, bogie frames, vacuum circuit breakers and propulsion systems are being manufactured in India.

The central government’s Make in India initiative, launched in September 2014, has laid special emphasis on promoting manufacturing activities in the country. Further, in 2017, the Ministry of Housing and Urban Affairs mandated conditions in tender documents to ensure that 75 per cent of the railcars and 25 per cent of the critical equipment and subsystems are made in India. There is a cap of 25 per cent for the production of railcars outside India and the remaining 75 per cent have to be necessarily manufactured in India either through tie-ups or through a wholly owned subsidiary. The move is likely to enable technology transfer, cost reduction, de-risking from exchange rate fluctuations, establishment of ancillary units along with manufacturing plants, etc.

In fact, global players such as Bombardier, Alstom and Rotem have already set up manufacturing bases in India. CRCC has also entered into an MoU with the Maharashtra government for setting up a manufacturing facility in MIHAN – the Multimodal International Cargo Hub and Airport at Nagpur.

Alstom, which has supplied metro cars to Lucknow, Chennai and Kochi, has increased the level of localisation with each of the projects. For the Chennai metro, the level of localisation was around 30 per cent, for the Kochi metro it rose to 60-65 per cent and for the Lucknow metro, it increased to 70-75 per cent.

Even though a few large global manufacturers have established their manufacturing units in India, several hurdles continue to affect their productivity and expansion plans. For instance, in many cases when the loan is tied to a financier, the latter puts various restrictions on the design and supply of rolling stock. This restricts the manufacturer’s capacity and capability to provide rolling stock. Occasionally, the financier mandates that the operators procure the rolling stock from companies based in their own country.

Conclusion

The expanding metro rail networks across the country are creating huge opportunities in the rolling stock market. Favourable domestic policies combined with massive network expansion plans have provided a major push to global as well as domestic manufacturers. To cater to this large demand, Indian companies are tying up with global manufacturers for technology transfer, foreign companies are expanding their manufacturing base in India and new players are looking for strategic tie-ups to enter the market. However, the stringent rolling stock specifications by financiers continue to remain a major hurdle for the manufacturers. Additionally, technical issues such as malfunction of rolling stock, including problems with doors, speed-monitoring systems and braking systems, as well as mishandling by passengers are key issues of concern for metro rail authorities.

That said, the rolling stock market for metro rail systems is set to witness considerable activity over the next few years. As the market expands, increased competition with large global players will lead to improved product quality and service options for operators and developers. This will ensure the adoption of advanced technologies and solutions, enable technology transfer, reduce costs, and drive the establishment of ancillary units along with manufacturing hubs.

Nikita Chhabra