The government of India finally completed the divestment of its 73.47 per cent stake in the Dredging Corporation of India (DCI) in March 2019, selling its share to four major ports. The process of disinvestment of DCI, however, has not been smooth. Initially, the plan was to privatise DCI, but, in the face of persistent resistance by trade unions and employees, the government got four central government-owned, cash-rich major port trusts to pick up a stake in DCI instead. Though this move is expected to increase operational efficiency, the real impact of the disinvestment on operations will take some time to be visible.

Disinvestment: Details and impact

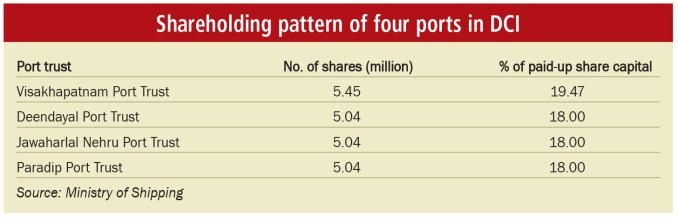

In 2018, the Cabinet Committee on Economic Affairs gave in-principle approval for strategic disinvestment of 100 per cent of the Government of India’s share in DCI to a consortium of four ports. The four ports are the Visakhapatnam Port Trust, the Paradip Port Trust, the Jawaharlal Nehru Port Trust (JNPT) and the Deendayal Port Trust (formerly Kandla Port Trust).

On March 8, 2019, the share purchase agreement (SPA) was executed between the government and the four ports, leading to a transfer of the government’s 73.47 per cent holding in DCI to the four ports. As per the SPA, the four ports are barred from selling DCI shares for three years beginning March 8, 2019. Moreover, they are not allowed to retrench DCI’s employees for one year, beginning March 8, 2019. RBSA Advisors was appointed as the transaction adviser, while Link Legal was hired as the legal adviser to offer advice and manage the disinvestment process.

The move has received a mixed reaction from industry stakeholders. The argument in favour of the disinvestment is that it will help the public sector undertaking (PSU) improve its capability with more efficient technology and the necessary infrastructure to bring it at par with global companies.

For the government, disinvestment instead of privatisation, is being regarded as a safe bet. It is also being argued that divesting the shareholding to four central government-owned ports is not going to help much.

The port trusts need to keep their annual expenditure on maintenance dredging to the minimum. This is because dredging expenses are generally priced into vessel-related charges (VRCs) which ports collect from the primary users, shipping lines. VRCs at major port trusts are already considered high as compared to neighbouring ports in the region. Any further increase in dredging costs will have to be recovered from shipping lines by raising the VRC. This, in turn, may force companies to divert ships to less expensive, more efficient private ports operating in the vicinity, such as Mundra instead of JNPT and Deendayal, Gangavaram instead of Visakhapatnam, and Dhamra instead of Paradip.

Further, the four port trusts after gaining control of the dredging company are likely to give work to DCI on a nomination basis, that is, without a tender at their own ports. In this way, these ports can secure the lowest possible rates for maintenance dredging at their ports.

Further, the four port trusts after gaining control of the dredging company are likely to give work to DCI on a nomination basis, that is, without a tender at their own ports. In this way, these ports can secure the lowest possible rates for maintenance dredging at their ports.

This though will lead to an ironical situation. The four port trusts can get a 16 per cent return (which is the government benchmark in approving capital investments in major port trusts) through dividends from DCI. To achieve this, however, DCI will have to raise its revenues and net profits significantly from what it has been reporting in the past. This, in turn, will mean that DCI will have to increase the per cubic metre (cum) rate for maintenance dredging, which is currently hovering between $1-2 and $5-6.

Company background

Company background

DCI was incorporated on March 29, 1976, as a wholly owned Government of India undertaking, with the primary objective of catering to the dredging requirements of the country’s ports. Subsequently, the government divested 1.44 per cent, 20 per cent, 5 per cent and 0.09 per cent (employee offer) of its shareholding in the company in 1992, 2004, 2015 and 2016 respectively. As of December 31, 2018, promoters held the largest stake in the company at 73.47 per cent, followed by non-institutional investors at 17.66 per cent, insurance companies at 6.71 per cent, and others at 1.96 per cent.

The corporation has undertaken a number of maintenance and capital dredging projects for major ports, non-major ports and the Indian Navy. During 2017-18, maintenance dredging work was carried out for Kolkata port, Cochin port, Kandla port, Mumbai port, Visakhapatnam port, Ratnagiri Gas and Power Private Limited, Gangavaram port, Cochin Shipyard Limited, Ultra Dimension Private Limited and Vizag Sea Port Private Limited. During the same period, capital dredging contracts were carried out for Paradip port, the Andaman Lakshadweep Harbour Works, Puducherry port, Mongla port in Bangladesh, and the Dahej and Ghogha ports. These projects were executed either under existing contracts or under renewed contracts entered into with the ports.

DCI also secured a dredging contract with Haldia/Kolkata port for five years starting January 1, 2017. In 2017-18, the company dredged 47 million cum, which was 78 per cent of the target set for the year. As of March 31, 2019, DCI had 11 trailer suction hopper dredgers, two cutter suction dredgers, one backhoe dredger, one inland dredger and three ancillary crafts. On the financial front, DCI has never incurred losses ever since it came into existence, and is in fact ranked among the top five dredging companies in the world.

Future plans

Future plans

DCI is looking at diversification, both in its existing core business and entering new business areas. In the core business, diversification will include offering dredging services in areas other than maintenance and capital dredging as well as geographical diversification. The other segments will include aggregate dredging, oil and gas dredging, shallow water dredging, offshore mining and land reclamation activities.

DCI is also planning to diversify geographically and is already executing a dredging contract for Mongla port in Bangladesh. The company has also signed a contract with the National Highways Authority of India (NHAI), under which DCI will bring the sand from abroad either on its own or through consortium partners and NHAI will facilitate the sale of this sand for mega road projects and bridges, and other construction projects across the country that are facing sand shortages.

The company is also exploring new businesses which include forward and backward integration opportunities for DCI which can bring high synergy among its businesses. Forward integration includes diversifying into those businesses that use dredging services such as ports, marine construction and offshore installation activities, while backward integration includes opportunities such as shipbuilding, ship repair, and bunker barge and spare parts manufacturing.

The company also plans to have tie-ups with ship repair yards for continued maintenance of its dredgers in order to make them available for a guaranteed minimum number of days every year. In this regard, a long-term MoU was signed with Cochin Shipyard Limited. DCI has already tied up with another PSU – BEML – for indigenisation of select spare parts.

With regard to its fleet, DCI plans to hire higher capacity trailer suction hopper dredgers and refurbish the existing aged dredgers. It has also added an inland cutter suction dredger to its fleet. Further, the company is exploring strategic alliances with major ports to enable advanced planning for deployment of vessels.

Conclusion

Conclusion

The disinvestment of DCI was undertaken to upgrade existing technology, improve service capability through necessary capital infusion, and bring in more experienced and professional management to optimise operations. Only time will tell whether or not the move will be beneficial. This cannot be ascertained at present as the four ports will need to synchronise their efforts and use the services of the virtually in-house dredging company judiciously.